First Year University Expenses

When I was looking for information about university expenses a year ago, I didn’t get the most accurate responses. Hopefully, after reading this blog post, you will be more informed about the total costs.

University is an exciting experience, but it sure doesn’t come cheap.

1. Tuition

Tuition is easily the largest incurred expense. The costs varies across programs, schools, and location in Canada. The average undergraduate tuition increases by about 3% each year for domestic students and 6% for international students.

View undergrad tuition costs spreadsheet here: https://goo.gl/aKML14

I’ve compiled a spreadsheet of undergraduate tuition costs (thanks to Stats Canada). These numbers give you a pretty accurate amount that you should expect to pay. All of these numbers assume you are a domestic student enrolled in a full course load. International students should expect to pay between $20,000 to $40,000 for tuition per year.

Programs like arts, humanities and science are regulated, which means all schools in Ontario charge a similar amount of $6,000 - $6,500. Engineering, math and computer science programs should be very close as well, though some schools attract higher fees. For example, York Engineering charges $8,800, whereas Waterloo & U of T Engineering charges about $13,000 (the average in Ontario is $10,500).

Professional programs such as business and accounting are not regulated, so their costs vary greatly. I’ve compiled the cost for ten popular programs.

For those interested in a detailed history of Waterloo tuition costs, check out this page. To find your exact tuition, simply google it.

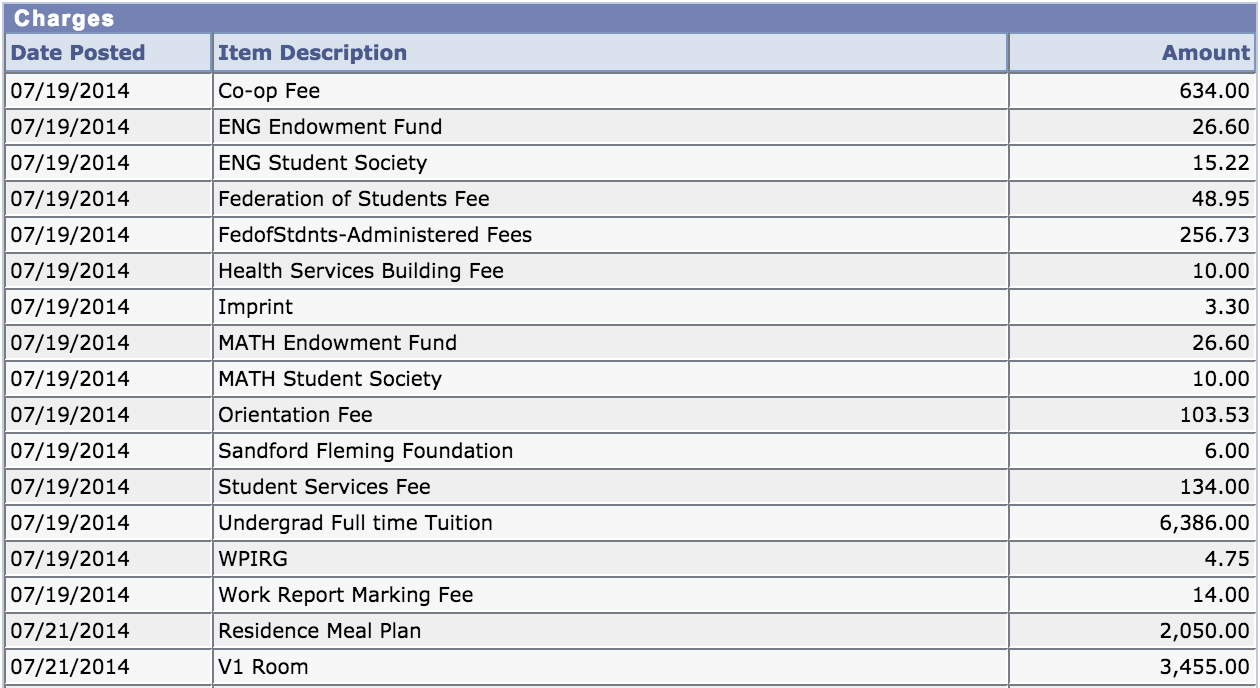

2. Other Academic Fees

View other academic fees spreadsheet here: https://goo.gl/NTUwA8

This category includes non-tuition fees such as textbooks, student societies, endowment funds, orientation week, building fees, student service fees, health and dental coverage, co-op fees, etc. The majority of these fees are mandatory. Some fees are refundable, but students don’t usually opt out because 1) they think it’s for a good cause or 2) it takes too much work to get a refund.

My total ‘Other Academic’ fees is about $1,170 per term, or $2,340 per year. A large portion of this price comes from the co-op program fee. Generally, students in regular programs should expect to pay about $1,000 to $1,500 per year for other academic fees.

3. Residence

View residence costs spreadsheet here: https://goo.gl/kvOsGY

Depending on your situation, this category could cost or save you a lot of money. For my first year, I lived in a single room at Village One residence at a monthly cost of about $740. I also was required to purchase a meal plan. In general, residences are more expensive than living off-campus. However, I would recommend living in residence for your first year to have an easier time adjusting to university and meeting new people.

The other option is to save some money and live off-campus. Some places are quite far, so you might have to commute to school. You can either sign a one year lease or sublet from someone else for four months. I would say the average place costs about $500-600 per month.

If it’s possible, you can always live at home with your family. It’s economical and comfortable.

4. Food

View food costs spreadsheet here: https://goo.gl/p9w23K

Food costs vary greatly depending on your eating and cooking habits. At traditional residences, you are required to purchase a meal plan, which costs $2,000+ per term. That’s $500/month already! You’re also going to get sick of eating the cafeteria food everyday, so you’ll most likely eat out a few times per week. That could run you another $100-200 per month, if not more. When I stayed at residence, I spent $700-900 per month on food (including the meal plan).

Another option is to cook! People who buys groceries and cook their own meals spend only about $150 to $250 per month on food. Eating out from time to time will increase this number to $300 per month.

The most economical option is eating at your family’s home. You can virtually spend $0 if you’re very conservative. Buying food now and then will only cost you about $50 per month.

The least economical option is to eat out for every single meal. This can easily run you $700+ per month. I personally fall into this category. I tracked my all of my food expenses (includes going out with friends, coffee, etc.) for a month. Surprisingly, I spent only $463 in June.

5. Entertainment

This category includes anything from watching a movie, gym membership, buying others gifts, partying, etc. It is difficult to track this expense, but I would say I spend $50 a month on entertainment. Unless you’re spending well over $100/month, this category shouldn’t affect your total budget much.

6. Travel

Travel expenses include gas & insurance, bus pass, carpooling, and airplane tickets. I’m fortunate in the sense that I’m from the GTA and don’t have to spend much on travel expenses. I go back home once a month, which costs about $20 round trip. Waterloo students also get ‘free’ bus passes, so I never have to pay for local bus rides.

Some students may have to spend a significant amount on flying, whether it’s domestic or international. Some students have to commute to school every day. For example, a TTC monthly pass costs about $100 for U of T students. That’s $800 over an academic year!

7. Examples

View real life examples here: https://goo.gl/Lxiu7u

To get a complete picture of how much year actually costs, I’ve compiled a list of real students’ expenses. The participating students are from a variety of programs, lifestyles, and spending habits. In addition, I’ve anonymized their names. My total expenses from September 2014 to April 2015 was just over $27,000.

I hope you enjoyed this blog post, see you next time!